Some Ideas on Estate Planning Attorney You Need To Know

Some Ideas on Estate Planning Attorney You Need To Know

Blog Article

The Basic Principles Of Estate Planning Attorney

Table of ContentsEstate Planning Attorney - An OverviewEstate Planning Attorney Things To Know Before You BuyThe Buzz on Estate Planning AttorneyThe Best Strategy To Use For Estate Planning Attorney

Estate planning is an action plan you can utilize to establish what takes place to your assets and responsibilities while you're active and after you pass away. A will, on the various other hand, is a legal record that details how possessions are dispersed, that cares for youngsters and animals, and any kind of various other dreams after you die.

The administrator also needs to pay off any type of taxes and debt owed by the deceased from the estate. Lenders usually have a restricted quantity of time from the date they were notified of the testator's fatality to make cases against the estate for cash owed to them. Claims that are turned down by the executor can be taken to court where a probate court will have the last word regarding whether the claim is legitimate.

Estate Planning Attorney Things To Know Before You Buy

After the inventory of the estate has been taken, the value of possessions computed, and tax obligations and financial obligation repaid, the administrator will certainly after that look for consent from the court to disperse whatever is left of the estate to the beneficiaries. Any estate taxes that are pending will come due within 9 months of the day of fatality.

Each specific places their possessions in the depend on and names a person various other than their spouse as the beneficiary. Nevertheless, A-B depends on have actually become less prominent as the estate tax exemption works well for many estates. Grandparents may transfer properties to an entity, such as a 529 plan, to support grandchildrens' education.

Some Of Estate Planning Attorney

This approach includes cold the value of a possession at its value on the date of transfer. Appropriately, the amount of prospective resources gain at death is additionally iced up, permitting the estate organizer to estimate their potential tax obligation liability upon check these guys out death and far better plan for the settlement of income taxes.

If enough insurance coverage earnings are available and the policies are correctly structured, any kind of revenue tax obligation on the regarded dispositions of possessions adhering to the death of a person can be paid without considering the sale of possessions. Earnings from life insurance policy that are received by the recipients upon the fatality of the insured are generally revenue tax-free.

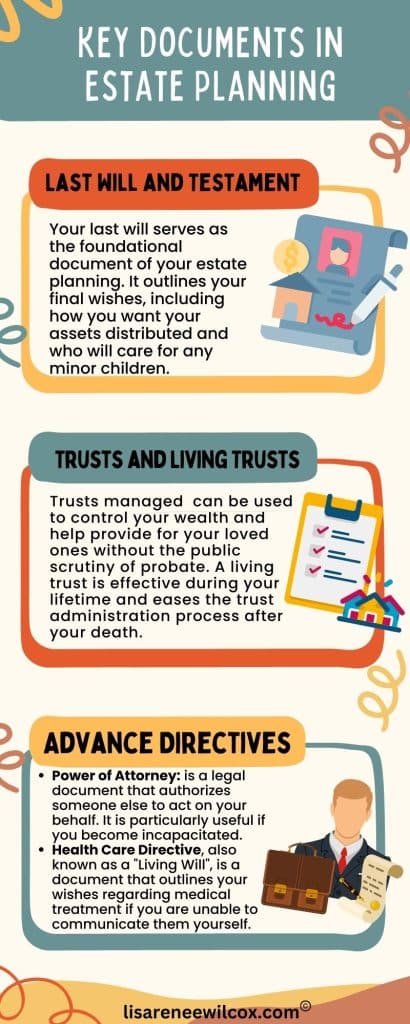

There are specific files you'll require as part of the estate preparation procedure. Some of the most typical ones consist of wills, powers of attorney (POAs), guardianship classifications, and living wills.

There is a misconception that estate preparation is just for high-net-worth individuals. That's not true. Estate planning is a device that every person can make use of. Estate intending makes it easier for people to identify their desires prior to and after they pass away. In contrast to what most individuals think, it prolongs beyond what to do with assets and responsibilities.

Estate Planning Attorney Fundamentals Explained

You should begin intending for your estate as quickly as you have any quantifiable asset base. It's a recurring process: as life proceeds, your estate strategy must move to match your situations, in line with your new goals.

Estate planning is commonly believed of as a device for the wealthy. Estate planning is also an excellent method for you to lay out strategies for the treatment of your minor children and pets and to outline your desires for your funeral service and preferred charities.

Qualified candidates that pass the test will be officially certified in August. If you're qualified to rest for the exam from a previous application, you may submit the brief application.

Report this page